17+ Debt amortization

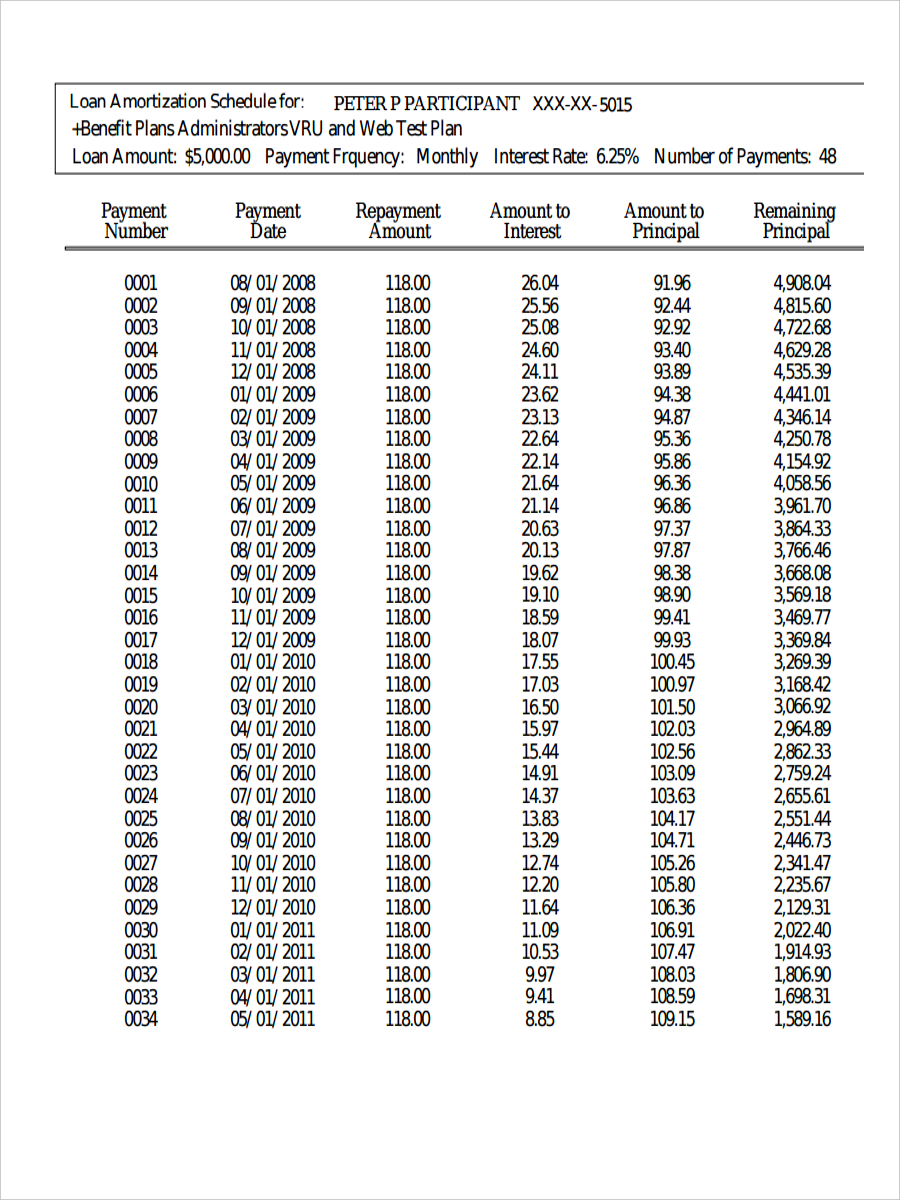

A debt amortization schedule usually has the entire payments youll make over the agreed duration. Amortization refers to the process of paying off a debt through scheduled pre-determined installments that include principal and interest.

Free 10 Loan Payment Schedule Samples In Ms Word Ms Excel Pages Numbers Google Docs Google Sheets Pdf

Be Debt-Free Faster Than You Think.

. Interest Rate APR Total. Payment Amount Principal Amount Interest Amount. Find your monthly interest rate.

Loan Payment Calculator With Amortization Schedule. The amount is 05. As a quick example if you owe 10000 at 6 per year youd divide 6 by 12 and multiply that by 10000.

You can use our loan amortization calculator to explore how different loan terms affect your payments and the amount youll owe in interest. Ad Reduce Debt With Best BBB Accredited Debt Relief Programs. Cut Debt by 50 or More.

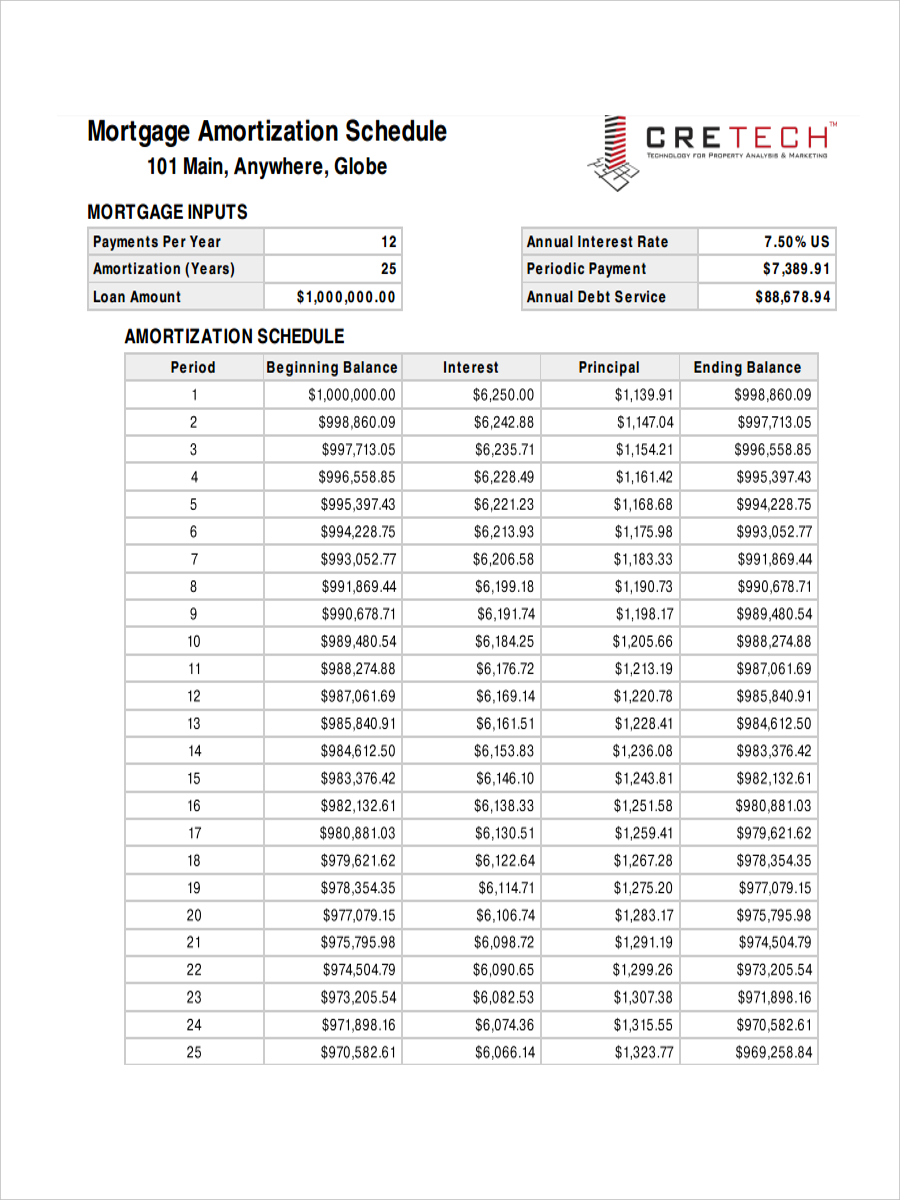

Ad If you have 10k in Debt JG Wentworth Could Help. You can also see an amortization schedule. It is most common for a commercial real estate loan amortization period to be between 20-30 years.

Multiply 150000 by 3512 to get 43750. Get a Quote Today. Commercial loans can often be interest only as well with no.

Use Our Comparison Site Find Out Which Lender Suits You The Best. Be Debt-Free Faster Than You Think. Fixed Payment The fixed amount you can pay every month.

17 Loan amortization Kamis 08 September 2022 Moreover some loan contracts may not. It also determines out how much of your repayments will go towards. Ad Our loan experts simple process can help you get up to 3000.

Ad Our 100 Financing Offer Means Select Home-buyers Arent Required To Pay A Down Payment. This amount would be the interest youd pay for the month. Months Until Pay Off How long it will take you to pay off a credit card.

Get a Quote Today. Ad Consolidate 20000 or more. Total Interest Paid The amount of interest you will pay.

January 28 2022 A Debt Amortization Schedule outlines how a company will be settling its debt and interest over time. Get Started in 5 Mins. This calculator will compute a loans payment amount at various payment intervals -- based on the principal amount borrowed the.

Its a schedule that provides information on debt and its repayment. Number of payments over the loans lifetime Multiply the number of years in your loan term by. We then use the PMT function to calculate the total payment amount for the period.

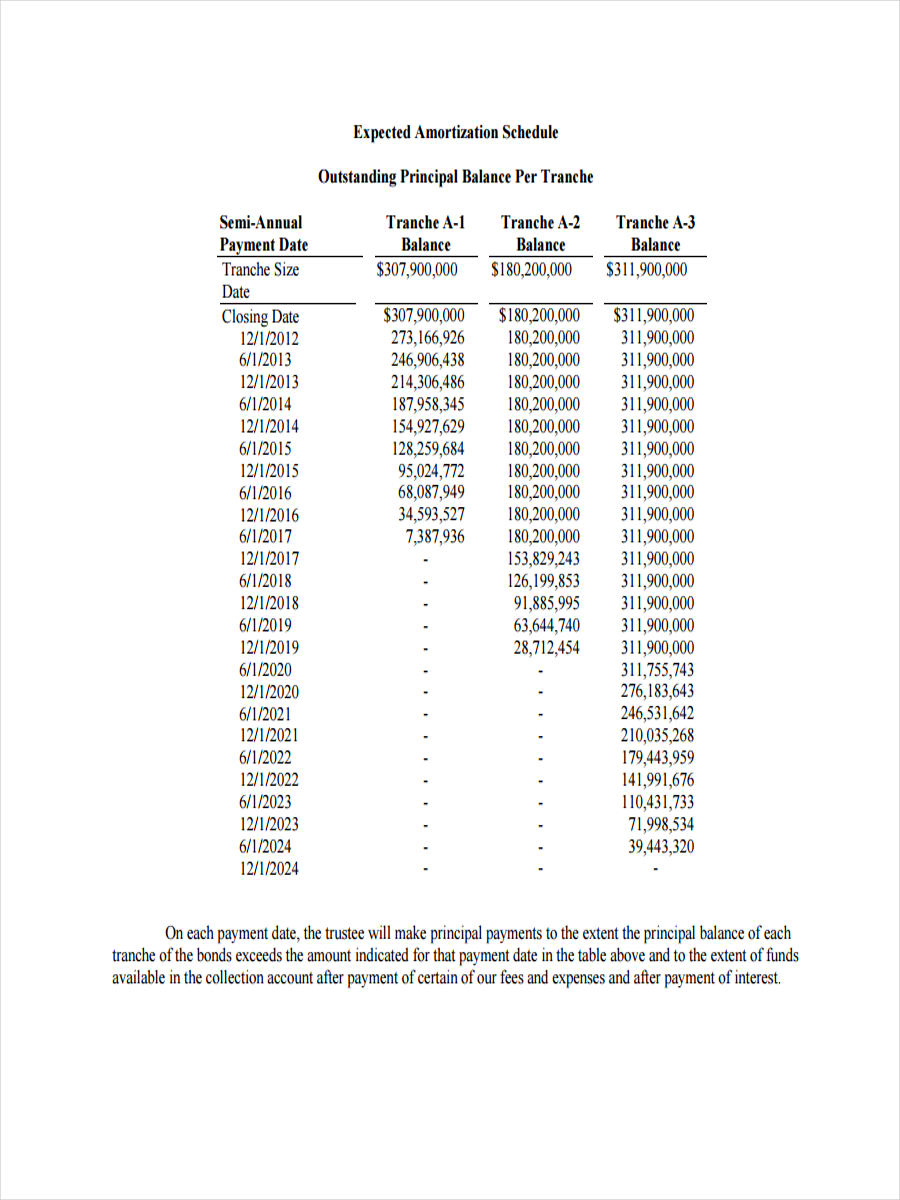

The required amortization is multiplied by the original principal. See If You Qualify. Modeling Debt Amortization in Financial Models.

Say you are taking out a mortgage for 275000 at 4875 interest for 30 years 360 payments made monthly. Starting at Period 1 of our Debt Amortization Schedule we link the opening balance. Debt Help without the Loans or Bankruptcy.

This amortization calculator returns monthly payment amounts as well as displays a schedule graph and pie chart breakdown of an amortized loan. Divide your interest rate by 12 to get your monthly interest rate. In almost every area where the.

1 Low Monthly Payment. If your interest rate is 5 percent your monthly rate would be 0004167 005120004167. Cut Debt by 50 or More.

Explore Debt Resolution Options Today. Heres how to calculate your amortization schedule step by step. Thats your interest payment for your first monthly payment.

Subtract that from your monthly payment to get your principal payment. Skip The Bank Save. The amount of amortization due is tied to the original debt principal ie.

I Financing Costs and ii Current. Ad Get Instantly Matched With The Ideal Pay Off Debt For You. Be Debt-Free Faster Than You Think.

However from the perspective of plan solvency and intergenerational equity there are best practices that a pension plan can follow in adopting the best possible amortization. This loan calculator - also known as an amortization schedule calculator - lets you estimate your monthly loan repayments. The Opportunity Mortgage Loan Offers Up To 100 Financing.

Amortization is the paying off of debt with a fixed repayment schedule in regular installments over a period of time for example with a mortgage or a car loan. 1 Low Monthly Payment. Say you are taking out a mortgage for 275000 at 4875 interest for 30 years 360.

Cash After Debt Amortization means for the fiscal year of the Borrower Net Cash After Operations less the sum of. Get Started in 5 Mins. Ad Consolidate 20000 or more.

Amortization Schedule Example Amortization Calculator Things Prepared Before Buying A Home Preparationof Homebuying Amortization Calculator Amortization Schedule Mortgage Amortization Mortgage Amortization Calculator

Debt Payment Plan Template Lovely Free Debt Reduction Calculator For Excel How To Plan Credit Card Infographic Word Template

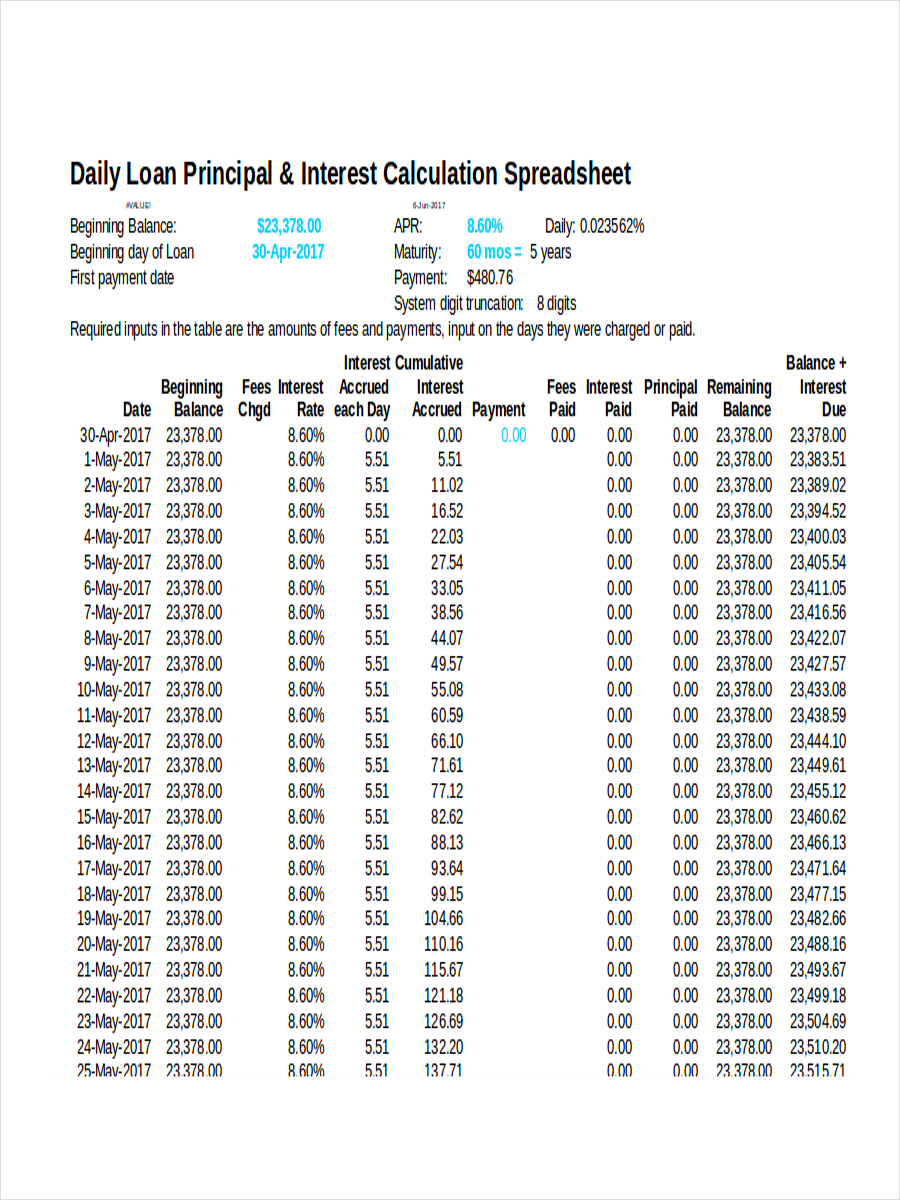

Tables To Calculate Loan Amortization Schedule Free Business Templates

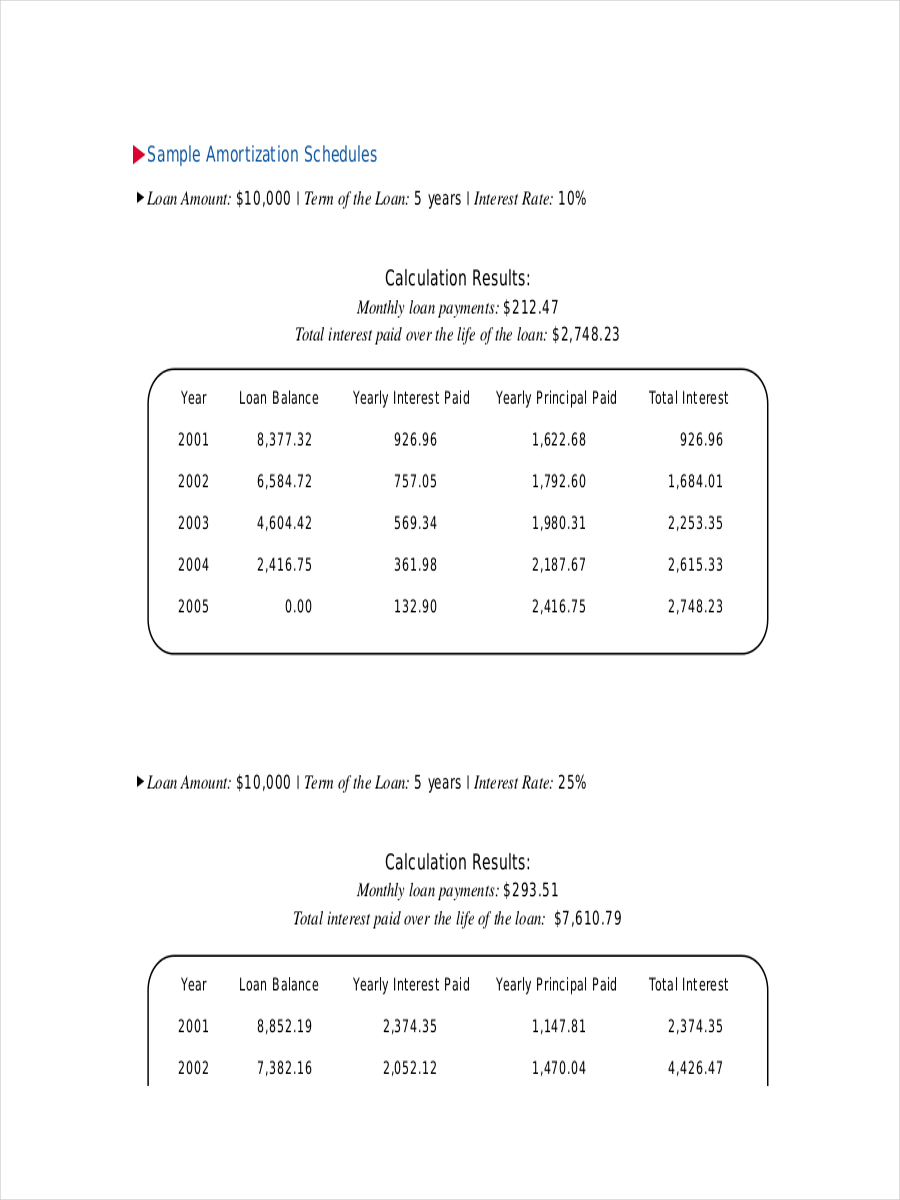

Amortization Schedule 10 Examples Format Sample Examples

Tables To Calculate Loan Amortization Schedule Free Business Templates

Free 10 Loan Payment Schedule Samples In Ms Word Ms Excel Pages Numbers Google Docs Google Sheets Pdf

Amortization Schedule 10 Examples Format Sample Examples

Free 10 Loan Payment Schedule Samples In Ms Word Ms Excel Pages Numbers Google Docs Google Sheets Pdf

Tables To Calculate Loan Amortization Schedule Free Business Templates

Tables To Calculate Loan Amortization Schedule Free Business Templates

Tables To Calculate Loan Amortization Schedule Free Business Templates

Amortization Schedule 10 Examples Format Sample Examples

Amortization Schedule 10 Examples Format Sample Examples

Tables To Calculate Loan Amortization Schedule Free Business Templates

Amortization Schedule 10 Examples Format Sample Examples

Amortization Schedule 10 Examples Format Sample Examples

Tables To Calculate Loan Amortization Schedule Free Business Templates